Canadian Housing Market Forecast 2024: A Comprehensive Outlook

The Canadian real estate market has experienced a period of unprecedented growth in recent years, fueled by low-interest rates, strong population growth, and a robust economy. However, as the economy enters a new phase and interest rates are expected to rise, the market is poised for a significant shift in 2024.

Key Trends Shaping the Market in 2024

Moderating Price Growth:

Price growth is expected to slow in 2024, with the national average price increasing by a moderate 0.5%. This moderation is due to a number of factors, including:

- Rising interest rates: The Bank of Canada is expected to continue raising interest rates in 2024, which will make it more expensive for borrowers to finance a home.

- Increased housing supply: The supply of new homes is increasing, which will put downward pressure on prices.

- Affordability concerns: Affordability is a major concern for many Canadians, and this is likely to continue to dampen demand in the market.

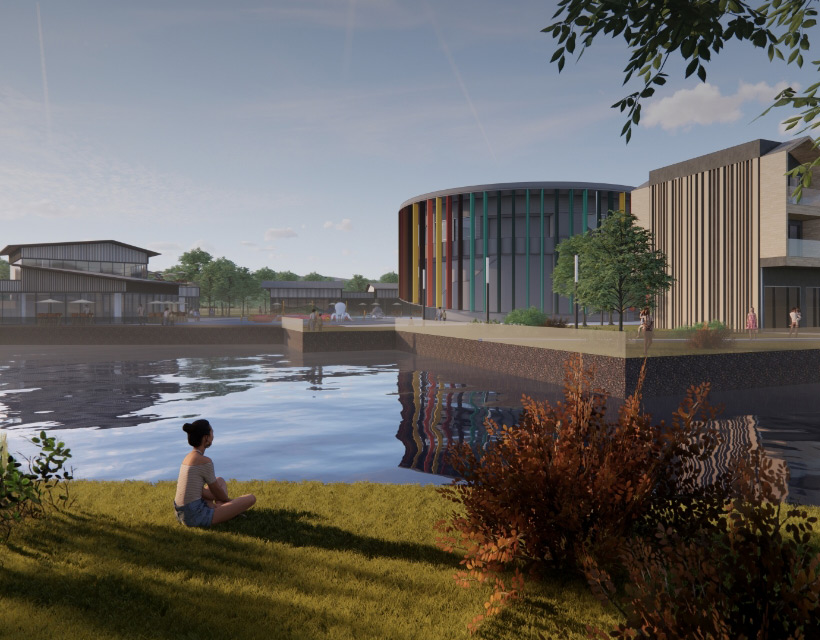

Rise of Non-Traditional Housing Options:

Non-traditional housing options, such as condominiums, townhouses, and purpose-built rentals, are expected to become increasingly popular in 2024. This is due to a number of factors, including:

- Millennials and Gen Z: Millennials and Gen Z are now the largest cohort of homebuyers in Canada, and they are more likely to rent or purchase non-traditional housing options due to affordability and lifestyle preferences.

- Urbanization: The population of Canada’s cities is growing rapidly, and this is driving demand for smaller, more affordable housing options.

- Changing lifestyles: People are increasingly seeking out housing options that offer more flexibility and convenience, such as being located close to amenities or transit.

Increased Demand for Housing in Smaller Cities:

The COVID-19 pandemic has accelerated the trend of remote work, which has led to increased demand for housing in smaller cities and rural areas. This is because people are no longer tethered to major cities for their jobs, and they can now enjoy a more affordable and less stressful lifestyle in smaller communities.

Impact of Rising Interest Rates:

Rising interest rates are expected to have a significant impact on the Canadian real estate market in 2024. Higher interest rates will make it more expensive for borrowers to finance a home, which could lead to:

- Decreased demand: As borrowing costs increase, some buyers may be priced out of the market.

- Longer selling times: Homes may take longer to sell as buyers become more cautious.

- Increased affordability concerns: Affordability will become an even greater concern for many Canadians, as higher interest rates will reduce their borrowing capacity.

Role of Technology:

Technology is playing an increasingly important role in the Canadian real estate market. Online platforms are making it easier for buyers and sellers to connect, virtual tours are becoming more common, and artificial intelligence is being used to automate tasks and provide insights.

Considerations for Buyers and Sellers in 2024

As the Canadian real estate market continues to evolve, it is important for buyers and sellers to be aware of the key trends and considerations that are likely to shape the market in 2024.

For buyers:

- Get pre-approved for a mortgage: This will give you a good understanding of what you can afford and will make your offer more attractive to sellers.

- Be prepared to act quickly: The Canadian real estate market is still very competitive, so you need to be prepared to act quickly when you find a home you like.

- Consider non-traditional housing options: If you are struggling to afford a traditional single-family home, consider non-traditional options such as condominiums, townhouses, or purpose-built rentals.

For sellers:

- Price your home competitively: The Canadian real estate market is still moderating, so it is important to price your home competitively to attract buyers.

- Make sure your home is in good condition: Buyers are increasingly willing to pay a premium for homes that are in good condition and move-in ready.

- Consider working with a real estate agent: A real estate agent can help you market your home effectively and negotiate with buyers.

Conclusion

The Canadian real estate market is expected to remain dynamic in 2024, with several key trends shaping the market. By understanding these trends, buyers and sellers can make informed decisions and navigate the market with confidence. While the market is likely to moderate in 2024, it will still offer opportunities for buyers and sellers who are prepared and informed.

Get in touch with us at 437-231-7260 for a private consultation.

Visit this link to search the most recent listings: https://sahilkhanna.ca/ or https://sahilkhannarealtor.com

We look forward to assisting you in reaching your objectives.