2024 Canadian Real Estate Market Trends: What Homebuyers and Sellers Need to Know

As we step into 2024, the Canadian real estate market continues to evolve, presenting both opportunities and challenges for homebuyers and sellers. Whether you’re looking to buy your first home, invest in property, or sell a current home, staying informed about the latest market trends is essential. This article delves into the key trends shaping the Canadian real estate market in 2024 and offers insights to help you navigate this dynamic landscape.

1. Rising Interest Rates: A Game Changer for Buyers and Sellers

One of the most significant factors influencing the Canadian real estate market in 2024 is the rising interest rates. After a period of historically low rates, the Bank of Canada has implemented gradual increases to combat inflation. This shift is having a ripple effect across the market:

- Impact on Buyers: Higher interest rates mean higher mortgage payments, which can reduce buying power for many Canadians. This trend may lead to a cooling of the market, particularly in cities like Toronto and Vancouver, where home prices have soared in recent years.

- Impact on Sellers: For sellers, rising interest rates could result in fewer bidding wars and longer time on the market. Pricing strategies will become more critical, as overly ambitious pricing may deter potential buyers who are more cost-conscious in this environment.

2. Urban Exodus Slows, Suburban Appeal Remains Strong

The pandemic-fueled trend of urban residents moving to suburban and rural areas for more space and affordability continues to influence the market, albeit at a slower pace. In 2024, the appeal of suburban living remains strong, but there’s a noticeable stabilization in urban centers:

- Urban Areas: Cities like Toronto, Montreal, and Vancouver are seeing a gradual return of buyers, particularly among younger professionals and families who value proximity to work, amenities, and cultural attractions.

- Suburban and Rural Areas: The demand for homes in suburban and rural areas remains robust, especially in regions offering a good quality of life, access to nature, and relatively affordable housing prices. However, price growth in these areas is expected to moderate as the market stabilizes.

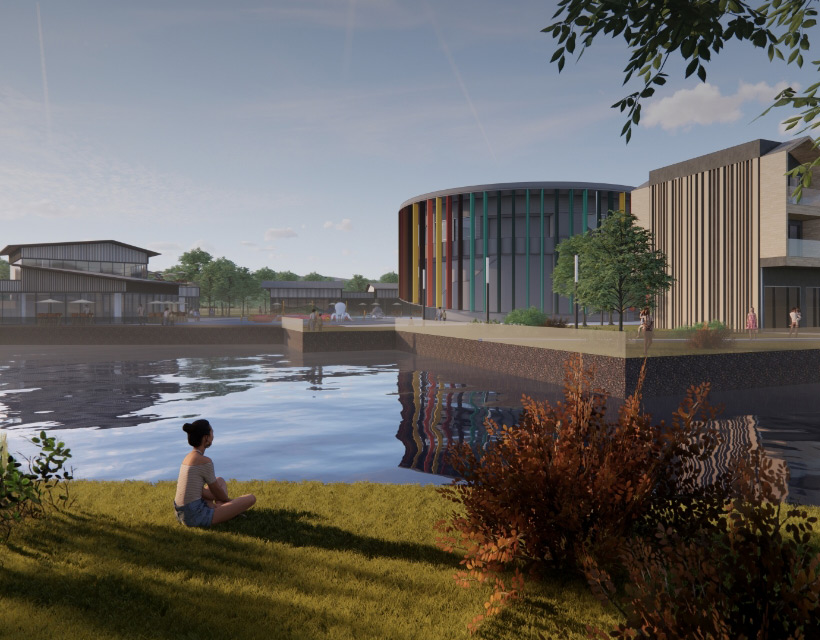

3. Increased Focus on Sustainability and Green Homes

Sustainability is becoming a significant consideration for Canadian homebuyers in 2024. As awareness of environmental issues grows, more buyers are seeking homes that are energy-efficient and eco-friendly:

- Green Homes: Homes with energy-efficient features, such as solar panels, high-efficiency HVAC systems, and sustainable building materials, are in higher demand. Buyers are increasingly willing to pay a premium for properties that offer long-term savings on energy costs and a reduced environmental footprint.

- Government Incentives: Various federal and provincial incentives are available to encourage the adoption of green technologies in homes. These incentives make it more attractive for homeowners to invest in energy-efficient upgrades, which can also increase the resale value of their properties.

4. Technology and Real Estate: The Rise of Virtual Home Buying

Technology continues to revolutionize the Canadian real estate market, with virtual home buying and selling becoming more prevalent in 2024. The pandemic accelerated the adoption of digital tools, and their popularity is here to stay:

- Virtual Tours and Open Houses: Many buyers now expect virtual tours and online open houses as part of the homebuying process. These tools allow buyers to explore properties from the comfort of their homes, making it easier to narrow down options before visiting in person.

- Digital Transactions: The entire real estate transaction process, from mortgage approvals to signing contracts, is increasingly being conducted online. This trend is particularly beneficial for out-of-town buyers or those with busy schedules.

5. Affordability Challenges Persist

Despite some market cooling, affordability remains a significant issue in many Canadian cities. The combination of high home prices, rising interest rates, and stagnant wage growth continues to put pressure on buyers, particularly first-time homebuyers:

- Government Measures: Various government programs, such as the First-Time Home Buyer Incentive and the Home Buyers’ Plan, are in place to help alleviate some of the affordability challenges. However, these measures may not be enough to counterbalance the broader market trends.

- Market Adjustments: In response to affordability concerns, some developers are focusing on building smaller, more affordable homes, including condos and townhouses, to cater to budget-conscious buyers.

Conclusion: Navigating the 2024 Canadian Real Estate Market

The Canadian real estate market in 2024 presents a complex landscape for homebuyers and sellers alike. Rising interest rates, shifting demographic preferences, and a growing emphasis on sustainability are just a few of the factors that will shape the market this year. Staying informed about these trends and working with a knowledgeable real estate professional can help you make the best decisions in this dynamic market. Whether you’re looking to buy, sell, or invest, understanding the current market conditions is key to achieving your real estate goals in 2024.