Why the Canadian Real Estate Market Remains Resilient Amid Global Economic Shifts

The Canadian real estate market has demonstrated remarkable resilience despite the ongoing global economic shifts and uncertainties. From fluctuating interest rates and inflation to geopolitical tensions and economic slowdowns, various factors have tested the strength of the housing market in Canada. Yet, it continues to attract investors and homebuyers alike, defying trends seen in many other countries. This article explores the key reasons behind the Canadian real estate market’s resilience and what it means for buyers, sellers, and investors in 2024.

1. Strong Demand Driven by Population Growth

One of the primary reasons the Canadian real estate market remains robust is the steady growth in population, fueled by high levels of immigration. Canada continues to be an attractive destination for newcomers, thanks to its strong economy, quality of life, and welcoming immigration policies. In 2024, the Canadian government is on track to welcome over 400,000 new permanent residents, many of whom will eventually enter the housing market.

- Impact on Demand: This steady influx of new residents keeps demand for housing high, particularly in major cities like Toronto, Vancouver, and Montreal. As demand continues to outpace supply in many regions, home prices remain stable, supporting overall market resilience.

2. Diverse Regional Markets and Economic Drivers

Canada’s vast geography and diverse regional markets play a crucial role in its real estate resilience. While some markets may experience temporary slowdowns, others continue to grow, thanks to local economic drivers:

- Strong Urban Markets: Cities like Toronto, Vancouver, and Montreal benefit from diverse economies, international appeal, and consistent demand for housing, particularly among young professionals and international investors.

- Emerging Secondary Markets: Smaller cities and suburban areas such as Halifax, London, and Kelowna are experiencing increased interest from homebuyers looking for more affordable options and a better quality of life. This shift helps balance the national real estate market, reducing the impact of downturns in any single area.

- Resource-Rich Provinces: Provinces like Alberta, Saskatchewan, and Newfoundland and Labrador, with their rich natural resources, continue to attract investment, creating jobs and driving demand for housing in these regions.

3. Stable Financial System and Conservative Lending Practices

Canada’s stable financial system and conservative lending practices are crucial factors in maintaining the strength of the real estate market:

- Stringent Mortgage Regulations: Canadian mortgage regulations, such as the mortgage stress test, ensure that borrowers can handle potential increases in interest rates. These regulations reduce the risk of defaults, protecting the market from a housing crisis similar to the one experienced in the U.S. during the 2008 financial meltdown.

- Healthy Banking System: Canada’s banking system is highly regulated, with well-capitalized banks that adhere to strict lending standards. This financial stability supports consumer confidence and ensures a steady flow of credit to qualified homebuyers, even during uncertain economic times.

4. Limited Housing Supply and High Construction Costs

The ongoing shortage of housing supply is another factor contributing to the resilience of the Canadian real estate market. Several elements contribute to the limited supply:

- Zoning and Regulatory Constraints: In many Canadian cities, zoning laws and lengthy approval processes for new developments limit the speed and volume of new housing construction. This keeps inventory low, supporting home prices even when demand moderates.

- High Construction Costs: Rising costs for construction materials, labor, and land development have led to slower growth in new housing starts. Builders face challenges in keeping up with demand, which further contributes to the scarcity of housing and supports property values.

5. Continued Foreign Investment Interest

Canada remains a popular destination for foreign real estate investors due to its political stability, strong legal framework, and desirable lifestyle. Despite various government measures, such as foreign buyer taxes and vacancy taxes, foreign investment continues to play a role in certain markets:

- Safe Haven Status: In times of global uncertainty, Canada’s real estate market is viewed as a safe haven for international investors. High-net-worth individuals and foreign corporations see Canadian property as a stable, long-term investment.

- Diverse Investment Options: From luxury homes in Vancouver to high-rise condos in Toronto, Canada offers a wide range of real estate investment opportunities that appeal to different types of investors, further supporting market resilience.

6. Low Vacancy Rates and Strong Rental Demand

Canada’s real estate market is also buoyed by low vacancy rates and strong rental demand, especially in major urban centers:

- Growing Rental Market: Many cities in Canada, including Toronto, Vancouver, and Montreal, have seen a surge in rental demand, driven by a mix of rising home prices, high immigration rates, and a growing number of people choosing to rent rather than buy.

- Low Vacancy Rates: In popular areas, vacancy rates remain low, pushing up rental prices and making property ownership more attractive for investors seeking rental income. This dynamic supports overall market stability by providing a consistent revenue stream for landlords and real estate investors.

7. Favorable Government Policies and Incentives

Various government policies and incentives continue to support the real estate market in Canada:

- First-Time Home Buyer Incentives: Programs such as the First-Time Home Buyer Incentive and the Home Buyers’ Plan offer financial assistance to first-time buyers, keeping demand steady and promoting homeownership.

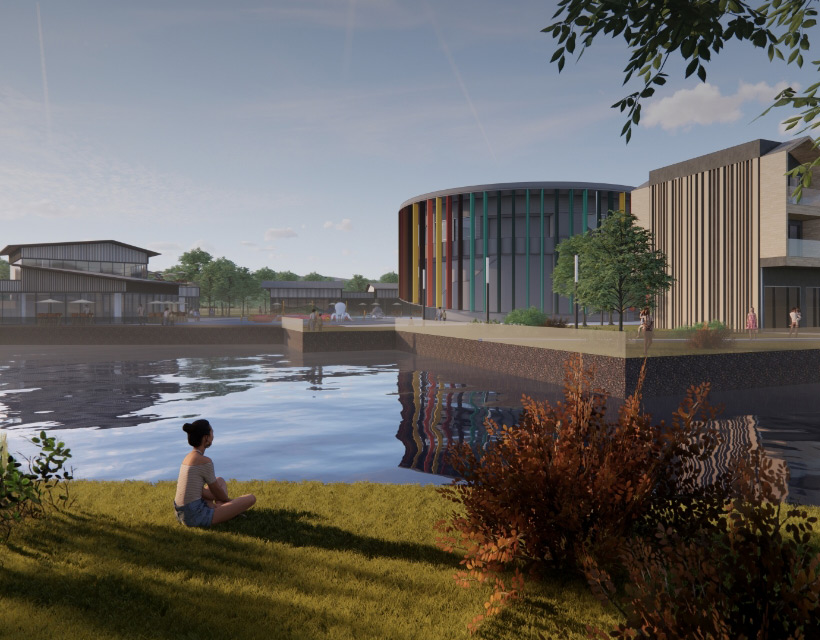

- Affordable Housing Initiatives: Federal, provincial, and municipal governments are investing in affordable housing projects to increase supply and address housing affordability issues, which helps stabilize the market in the long term.

8. Adaptability and Innovation in the Real Estate Sector

The Canadian real estate market has shown adaptability and innovation in response to changing conditions. From the increased use of technology in home buying and selling processes to the development of sustainable and energy-efficient housing, the market continues to evolve to meet the needs of modern buyers.

- Technology Adoption: Virtual tours, digital transactions, and online marketing have made it easier for buyers and sellers to connect, ensuring the market remains active even during periods of uncertainty.

- Sustainability Focus: The growing demand for green homes and sustainable communities reflects the market’s ability to adapt to new trends, further enhancing its resilience.

Conclusion: Why the Canadian Real Estate Market Continues to Thrive

While the global economy faces many challenges, the Canadian real estate market remains a pillar of stability and resilience. Factors such as strong population growth, diverse regional markets, stable financial systems, limited housing supply, continued foreign investment, and favorable government policies all contribute to its continued strength. For buyers, sellers, and investors, understanding these dynamics is key to navigating the market in 2024 and beyond.

Get in touch with us at 437-231-7260 for a private consultation.

Visit this link to search the most recent listings: https://sahilkhanna.ca/ or https://sahilkhannarealtor.com

We look forward to assisting you in reaching your objectives.