Is it Possible for Me to Afford Real Estate in Brampton, Ontario?

One of the most important questions you can have as a potential buyer of Brampton Real Estate is how much property you can afford.

Before starting the house-buying process, it’s crucial to have a clear picture of your financial status given the rising cost of living and home prices. In this article, we’ll look at the elements affecting how much housing you can purchase in Dufferin and offer advice for maximizing your spending power.

In the Dufferin area, which includes the neighboring towns of Brampton, Shelburne, East Garafraxa, Amaranth, Grand Valley, Melancthon, Mulmur, Mono, and Caledon, there is a group of knowledgeable real estate professionals known as The Sahil Khanna Realtor. They have established themselves as one of the best Royal LePage sales teams in Canada by offering individualized service, knowledgeable counsel, and a thorough comprehension of the regional real estate market.

Factors in Brampton, Ontario That Affect How Much House You Can Afford

YOUR INCOME:

Your salary is one of the most crucial elements in determining how much house you can afford in Brampton. How much cash you have available each month to contribute to a mortgage payment depends on your income. The debt-to-income ratio is a calculation that lenders frequently use to calculate the size of the mortgage you can afford. This ratio considers your monthly debt payments as a percentage of your monthly income, including your mortgage payment, credit card payments, and other loans. Lenders typically desire a debt-to-income ratio of no higher than 43%.

YOUR CREDIT SCORE:

When evaluating how much mortgage you can pay, lenders also take into account your credit score. Lenders use your credit score to assess the risk of lending to you based on your history of debt management. While a poor credit score may restrict your selections and result in higher interest rates, a high credit score might help you qualify for a larger mortgage and better rates. Before applying for a mortgage, it’s crucial to verify your credit score and, if required, take steps to raise it.

YOUR DOWN PAYMENT:

How much house you may afford in Ontario also depends on the size of your down payment. You’ll need to borrow less money if you put down a higher down payment, and you might be eligible for a cheaper interest rate. In Canada, 5% of the home’s purchase price must be put down as a minimum, however putting 20% or more down can save you from having to pay mortgage default insurance.

THE COST OF LIVING IN BRAMPTON, ONTARIO:

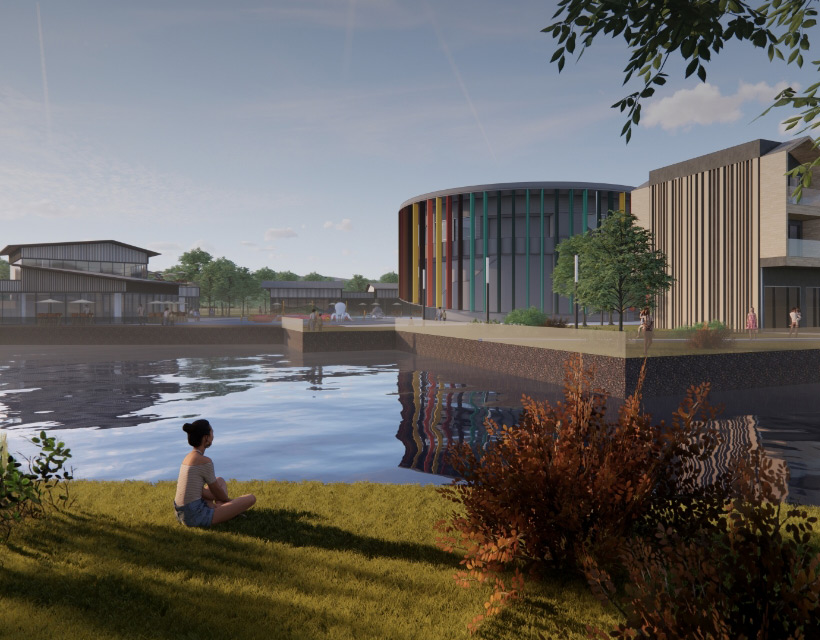

The amount of house you can afford depends on the cost of living in your area. Depending on the area, housing costs vary greatly in Ontario. The cost of housing is typically greater in urban places like Toronto and Ottawa, although smaller settlements in Dufferin County could provide more inexpensive options. It’s crucial to examine the cost of living in the place you want to live in and account for it in your spending plan.

How to Get the Most Out of Your Budget:

GET PRE APPROVED FOR A MORTGAGE:

It’s crucial to get pre-approved for a mortgage before you start looking for a home. A pre-approval can help you focus your search on properties that fall within your price range and will provide you with a clear knowledge of how much mortgage you can afford. Additionally, it’s an excellent method to demonstrate to sellers that you’re prepared to acquire and are serious about doing so.

CONSIDER ALL COSTS:

The total cost of homeownership must be taken into account when determining how much house you can buy in Ontario. This covers your property taxes, homeowner’s insurance, and upkeep expenses in addition to your monthly mortgage payment. The closing costs of buying a home, such as legal fees and land transfer taxes, must also be taken into account.

DON’T STRETCH YOUR BUDGET TOO THIN:

Despite the temptation to go beyond and purchase the house of your dreams, it’s crucial to be honest with yourself about your financial situation. Overstretching your finances can increase your risk of experiencing financial stress or possibly defaulting on your mortgage. Consider a house instead that comfortably fits inside your budget and leaves room for unforeseen costs.

Finding out how much house you can afford in Ontario can be made easier by working with a real estate expert. A qualified real estate agent can give you information about the local real estate market and assist you in finding properties that are within your price range. They can also put you in touch with reputable mortgage experts who can guide you through the home financing process. A real estate agent can also give advice on how to haggle for the greatest deal on your new house. Working with a real estate professional will give you access to priceless information and experience that will enable you to make wise choices and realize your dream of owning a house.

Our distinctive approach to real estate is the reason for our success. We value giving each customer individualized attention and developing enduring connections with them. We are able to offer specialized advise and support throughout the purchasing or selling process by taking the time to understand our client’s needs and aspirations.

Our comprehensive understanding of the areas we serve is one of our greatest assets. We can offer our clients helpful insights because we have a lot of knowledge about the neighbourhood real estate markets, educational institutions, and facilities. This information also enables us to create community-specific, targeted marketing plans. To ensure a successful sale, we recognize that each neighbourhood has its own distinctive selling characteristics and work to emphasize these to prospective buyers.

Beyond merely the purchasing or selling process, we are dedicated to providing individualized service. Long after the transaction is finished, we remain available to offer assistance and advise since we believe in developing long-lasting relationships with our clients. Our main objective is to assist our clients in realizing their objectives and creating a brighter future for themselves and their family.

We are committed to giving our customers the very best service and are pleased to serve the Dufferin area. We’re here to assist you in navigating the difficult real estate market with confidence and comfort, whether you’re a first-time home buyer or an experienced investor.

Get in touch with us at 437-231-7260 for a private consultation.

Visit this link to search the most recent listings: https://sahilkhanna.ca/ or https://sahilkhannarealtor.com

We look forward to assisting you in reaching your objectives.